Revolving line of credit calculator

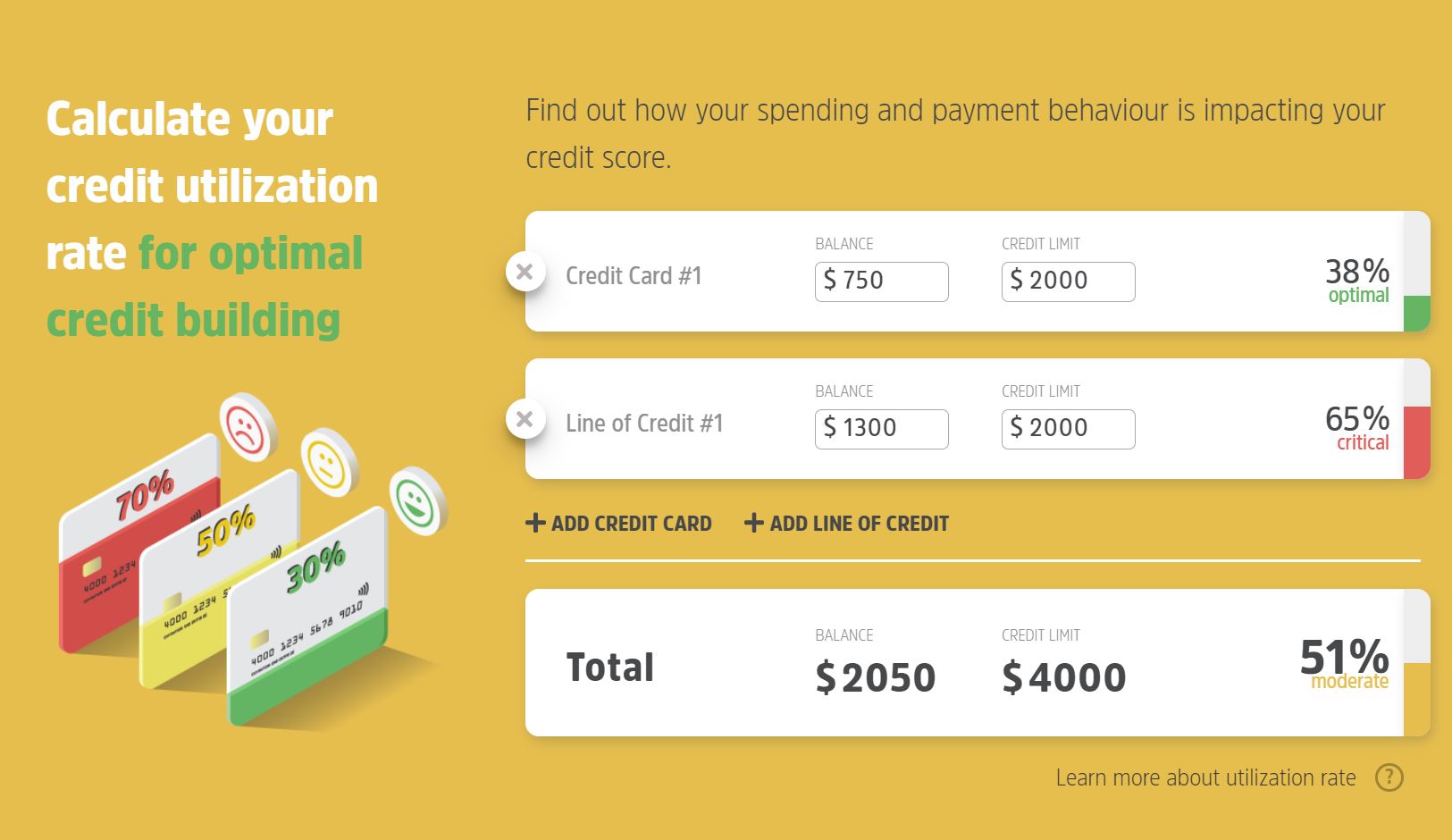

Use our credit utilization calculator to see where your credit card utilization stands so you can start repairing your credit score if needed. Home Equity Lines of Credit Calculator Why Use a Heloc.

6 Ways To Pay Off Credit Card Debt Bankrate

A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans Footnote 1 such as credit cards.

. Current HELOC rates 575 - 12625 APR 1. Type the amount youd like Enter. Your total available credit limit across all those same accounts.

This means you have a set amount of money available to borrow--with the flexibility to take what you need - as you need it. Basic interest calculator helps track monthly interest payments clearly illustrating which portion of your revolving credit payment is applied toward reducing your principal balance. A Home Equity Line of Credit HELOC is a revolving line of credit funded by the amount of equity you have in your home.

How to Improve Credit Score. ScotiaLine Personal Line of Credit. Draws are not permitted during the repayment.

Get a 099 intro APR for 6 months then variable APR applies. In terms of the HELOC you typically only need to make interest repayments during the draw period which is usually between 10-15 years. Access to line of credit for up to 10.

This means the principal borrowed amount can be paid off in full at any time. Total Per Week 0. You have access to a given set of funds in the same way you have a credit limit on the value of funds you can access via your credit card.

Minimum periodic payments made during the end of the draw period may not fully amortize the remaining balance of the line of credit at the maturity of the 30-year mortgage. We can show you how to unlock equity in your home to achieve the goals that you have now and in the future. Discover the power of a reverse mortgage line of credit with ARLO.

Personal Line of Credit is an unsecured consumer loan that consists of a two-year interest-only revolving draw period followed by a fully amortizing repayment period of the remainder of the term. As with a line of credit taking out a new credit card gives you a revolving account. It states that the companies are free to borrow funds from these financial institutions to fulfill their cash flow needs by paying off the underlying commitment fees.

A Regions Home Equity Credit Line is a flexible revolving line of credit thats secured by a primary or secondary residence. A home equity line of credit is a type of revolving credit in which the home is used as collateral. Scotia RSP catch-up line of credit.

Loan in a Line Options. Lower your overall. The property must be located in a state where Regions has a branch.

Line of credit calculator. In many ways HELOCs act in a very similar way to a credit card. A HELOC is a revolving line of credit.

For example if you apply and are approved for 100000 you could use up to 90000 to pay off student loans or other debt at origination which would leave an additional 10000 to draw on for future. Since opening a new line of credit puts a temporary dent on your credit score. A line of credit can be called a revolving credit Revolving Credit A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients.

Line of credit calculator. The 2-way revolving line of credit available at a minimal extra cost automatically deposits funds into your operating account when you are low and transfers funds back to pay your principal. Building a good credit history.

If you previously lacked a form of revolving credit on your record this improves your credit mix. There is no interest or repayment on unused funds. The loan backed by your home will be reported like other revolving credit.

The Personal Line of Credit will require 10 of the line amount to be unutilized at the time of origination with a maximum of 100000. In the case that a credit card holder falls very deeply into debt debt consolidation which is a method of combining all debt under a new line of credit can offer temporary relief. Think of it like a credit card with a limit determined by your homes equity typically with a much lower rate than a credit card.

Borrowers can use HELOC funds for a variety of purposes including home improvements education and the consolidation of high-interest credit card debt. The reverse mortgage line of credit is guaranteed for your lifetime and is revolving allowing for you to repay the balance at any time without penalty. 12 weeks 24 weeks Week Principal Fees Total per week.

Banks and other federally. Due to the foregoing the amortization schedule produced by the business loan calculator may differ from an actual payment schedule. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin.

For more information or to do calculations involving debt consolidation please visit the Debt Consolidation Calculator. Because the home is more likely to be the largest asset of a customer many homeowners use their home equity for major items such as home improvements education or medical bills rather than day-to-day expenses. However for the average Joe the most.

With this type of loan you only pay interest on the amount you use during the. All home equity calculators. ScotiaLine Personal Line of Credit STEP ScotiaLine Personal Line of Credit for students.

Rolling other debt into a secured credit line is an effective way to reduce interest costs on higher-interest borrowing particularly credit cards. Although you could potentially qualify for a credit limit of up to 65 of your homes value your real limit may be subject to a stress test similar to the mortgage stress test. A home equity line of credit is a type of second mortgage that allows homeowners to borrow money against the equity they have in their home and receive that money as a line of credit.

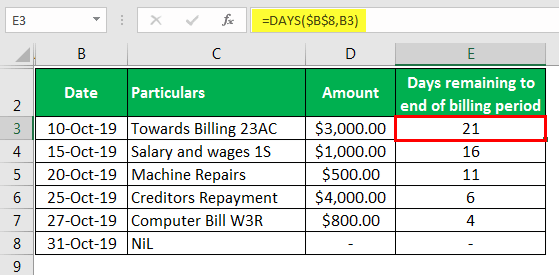

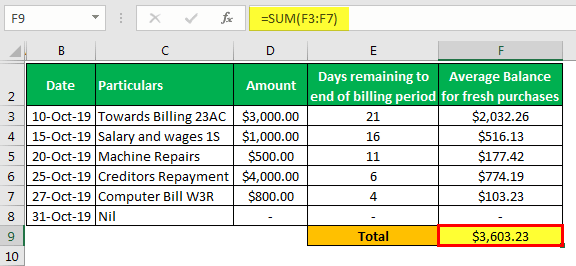

When you repay your balance the credit line is freed up to borrow again. Total Per Week 0 Prices shown assume a fee rate of 466 of the amount drawn for 12 week terms and 899 for. Unlike installment payments monthly revolving credit is based on spending activity occurring during the billing cycle.

A balloon payment may. And other revolving credit lines vs. A home equity line of credit from FNB 1 is a revolving line of credit.

The HELOC stress test. A HELOC often has a lower interest rate than some other common types of loans and the interest may be tax deductible. If you use a credit union or lock part of the HELOC into a regular mortgage you can borrow up to 80 of the homes value.

Prime - 050. What is a home equity line of credit HELOC. Auto loan payment calculator.

As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. The loan or lease decision. I have run your calculator and it shows 34625-year 1 line of credit and 44197 at year 10 on HECM Annual If I.

The APR will vary with Prime Rate the index as published in the Wall Street Journal.

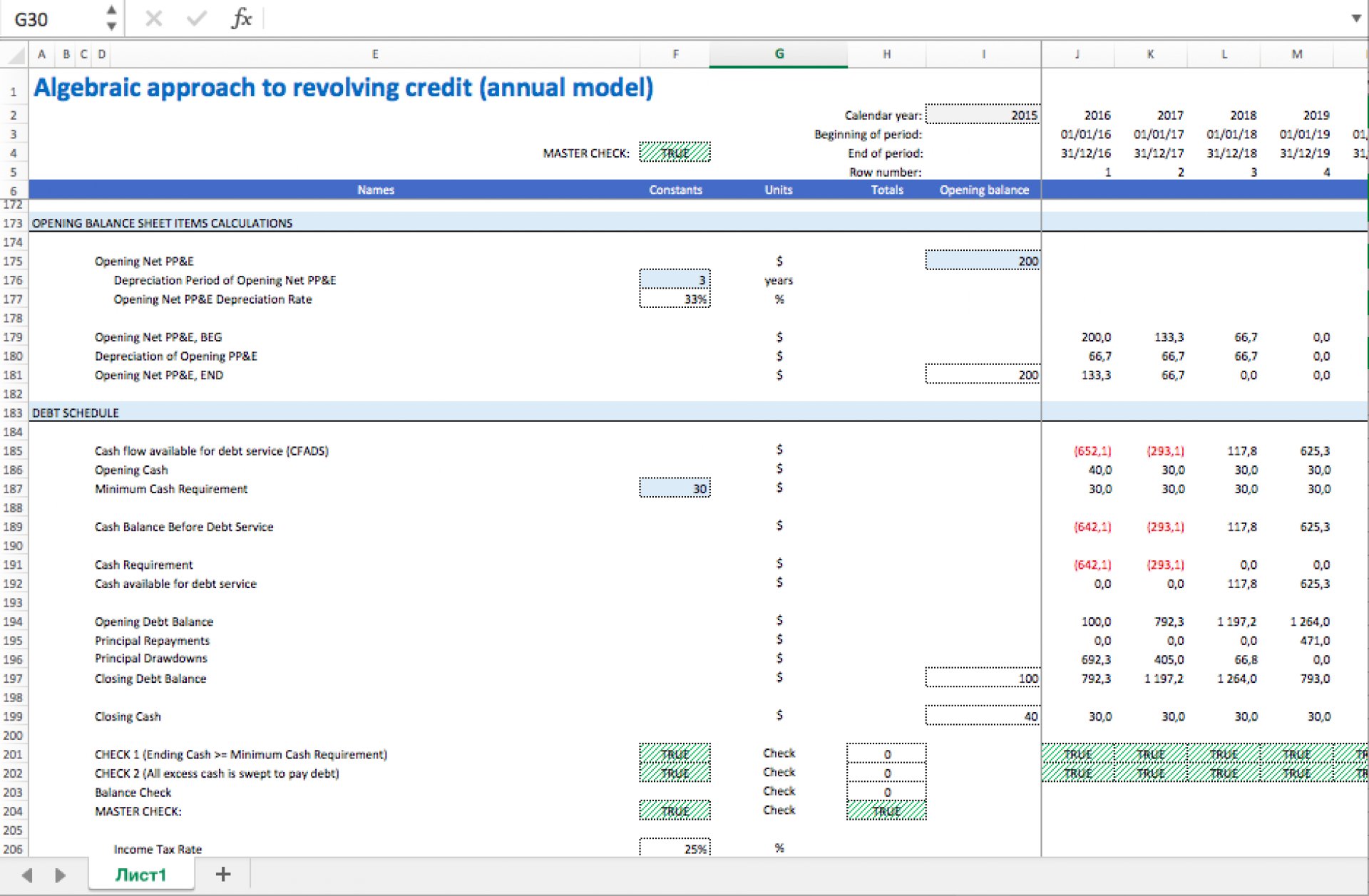

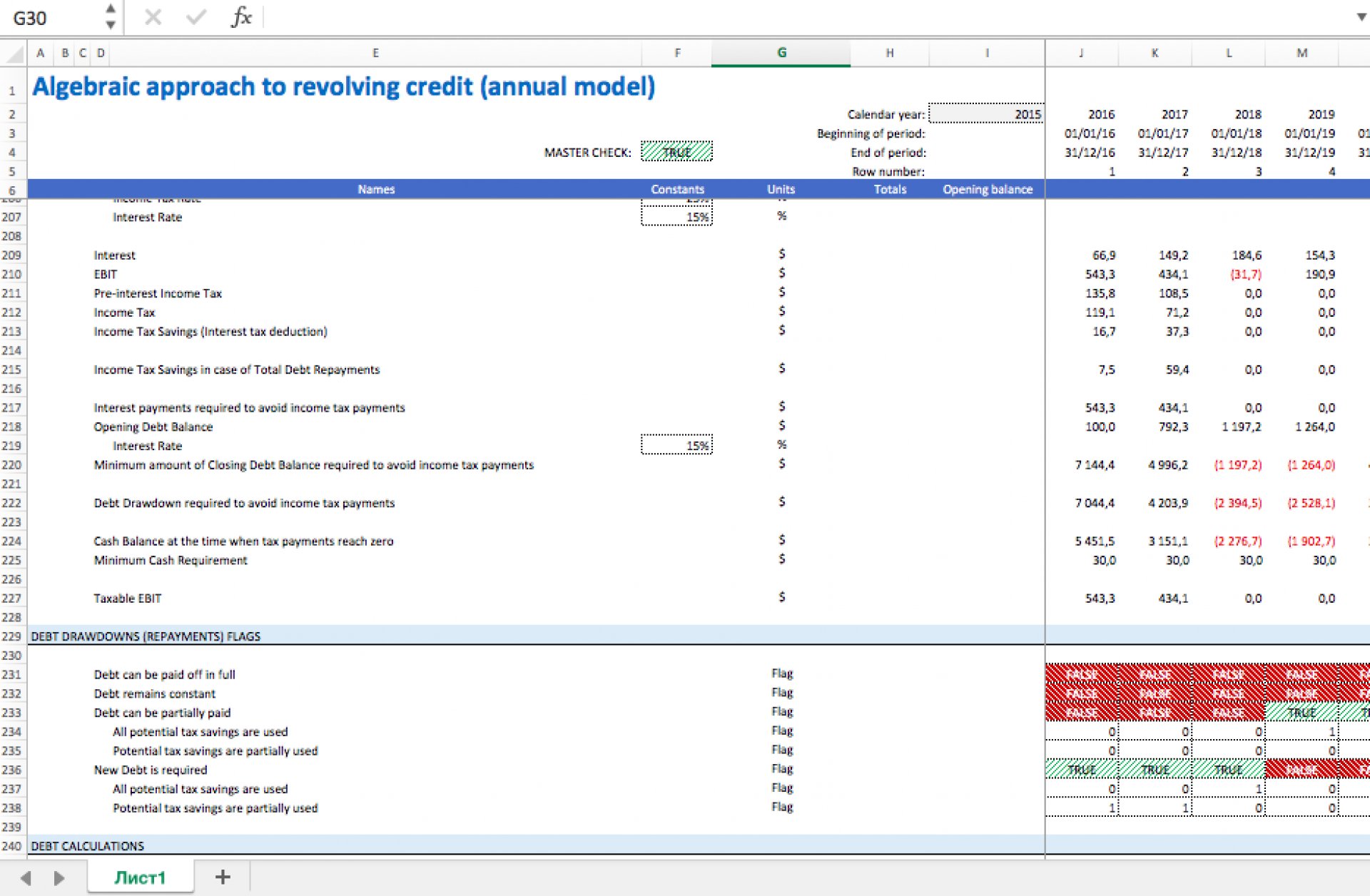

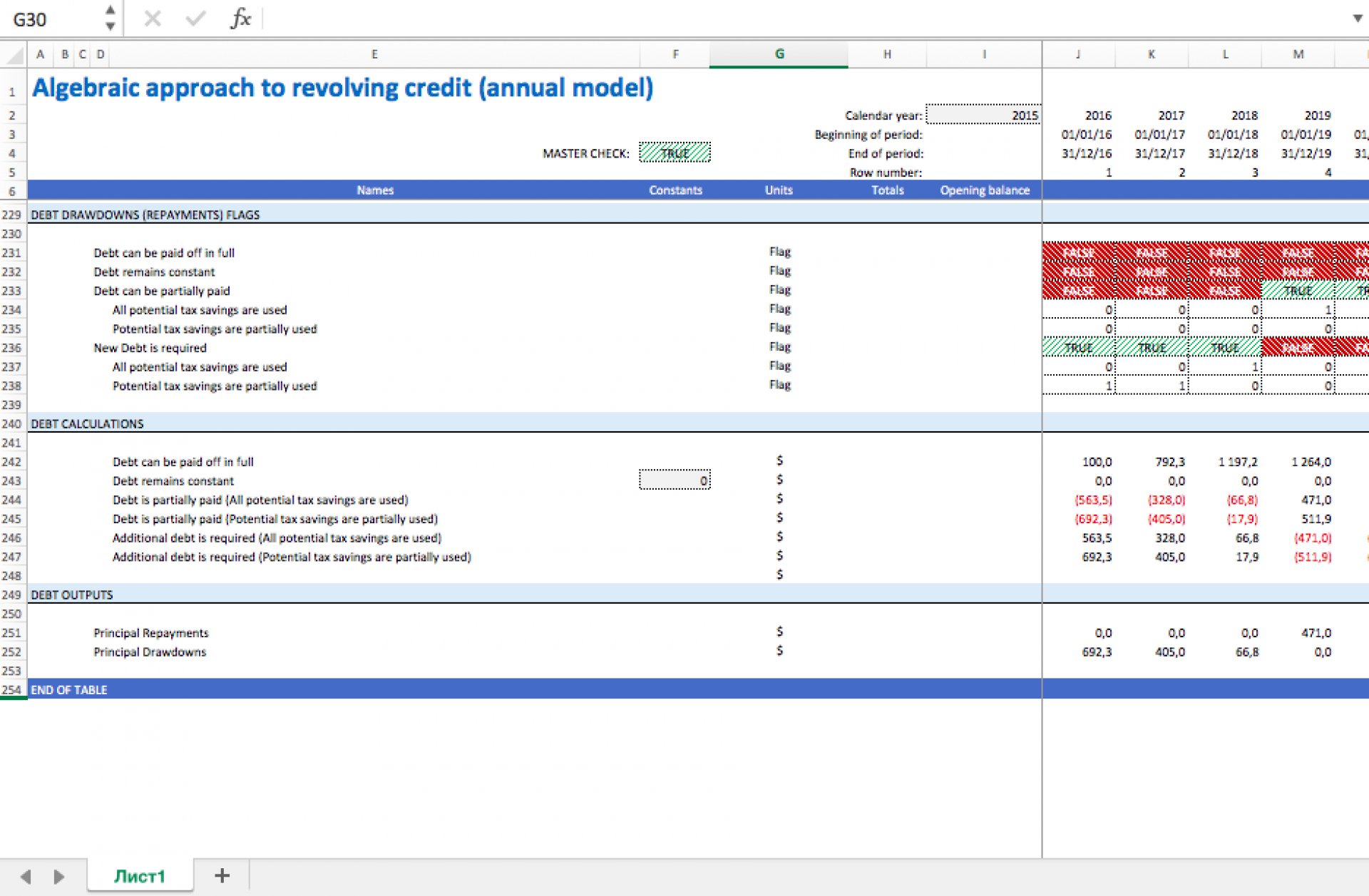

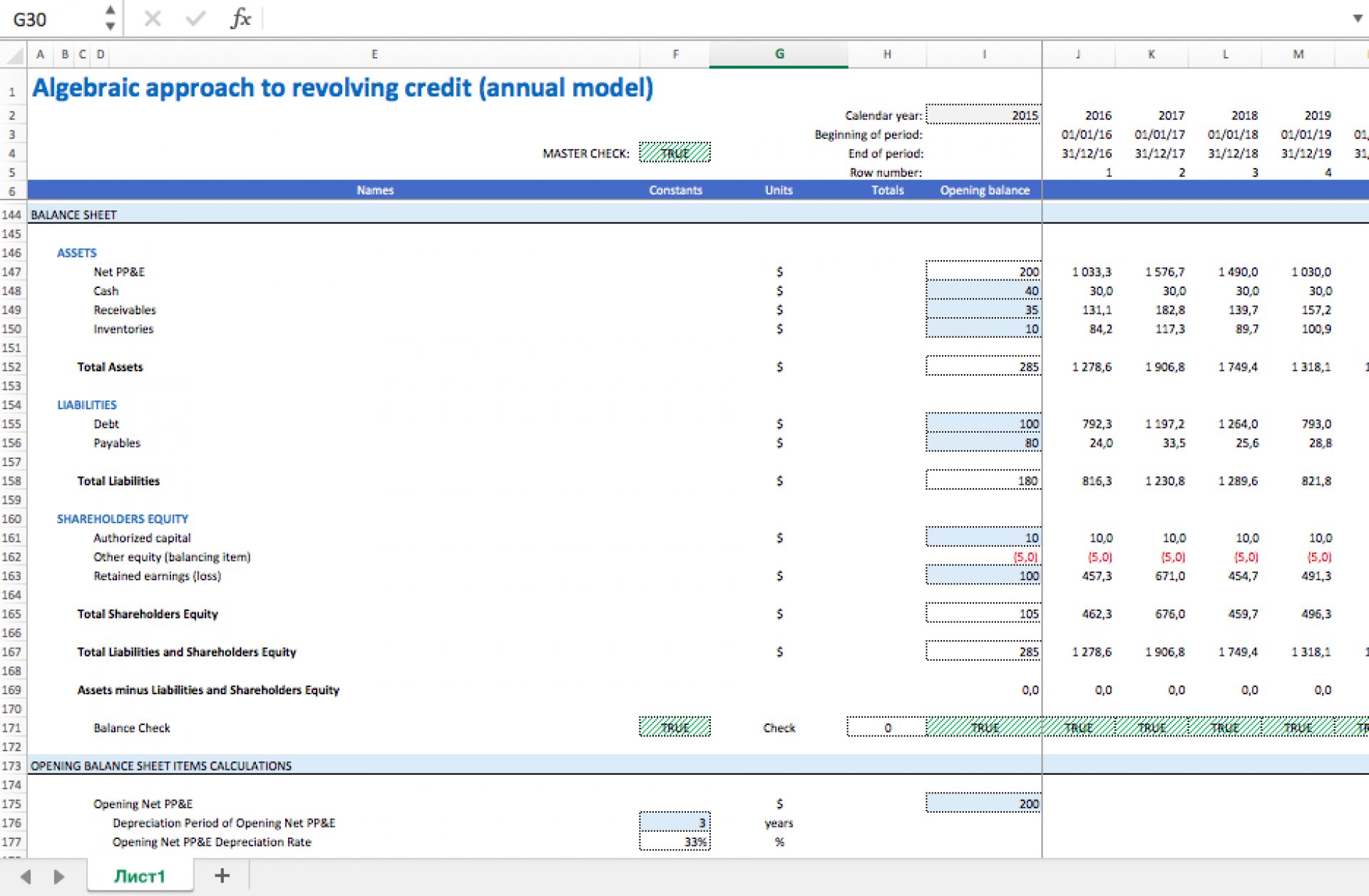

Excel Revolving Credit Calculator For Annual Models Eloquens

8 Point Credit Score Checklist To Boost Your Fico Fast Credit Score Credit Score Quotes Credit Repair Letters

/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

![]()

Line Of Credit Tracker For Excel

Excel Revolving Credit Calculator For Annual Models Eloquens

Line Of Credit Calculator How To Calculate Credit Loan Payoff

Line Of Credit Calculator How To Calculate Credit Loan Payoff

Calculate Payments For A Revolving Line Of Credit Lendio

Excel Revolving Credit Calculator For Annual Models Eloquens

Excel Revolving Credit Calculator For Annual Models Eloquens

Heloc Calculator Calculate Available Home Equity Wowa Ca

Credit Utilization Ratios Your Credit Score Refresh Financial

Modeling The Revolving Credit Line Excel Template

Modeling The Revolving Credit Line Excel Template

Fico Score Formula Understanding Mortgages Fico Score Credit Score

Credit Scores 101 Understand Exactly What Goes Into The Calculation With This Easy Visual And Get Step By Step I Credit Score Fico Credit Score Fix My Credit

Excel Revolving Credit Calculator For Annual Models Eloquens